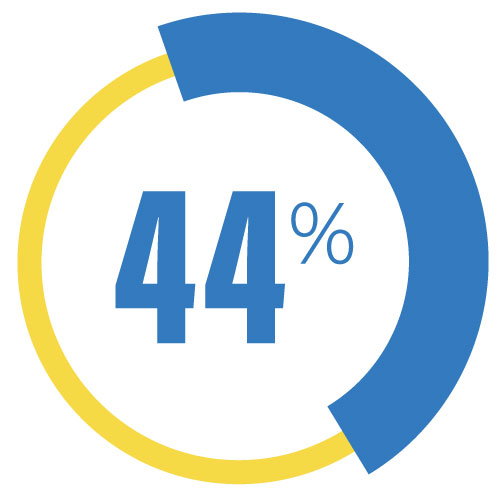

In 2022, 44% of bank and credit union CEOs ranked increasing operational efficiency as the most important strategic priority to achieve. Identifi can help you do just that: Increase efficiency, unify data and automate your processes so you can remove the friction from your business and save serious revenue.

Banks and credit unions rely on our industry-leading Enterprise Content Management (ECM) platform for

Identifi Workflow to create automated business processes for loans, deposits, HR, sales, marketing, IT, and much more. Institutions also use document tracking, e-signatures, analytics and e-receipts they need to provide unparalleled customer service and eliminate the friction in their businesses.