Your systems aren’t broken—they just don’t communicate. Identifi bridges cores, loan origination systems, MFPs, and business apps to create unified workflows that eliminate data silos, all without costly replacements or workflow disruption.

WHAT YOU CAN DO WITH IDENTIFI

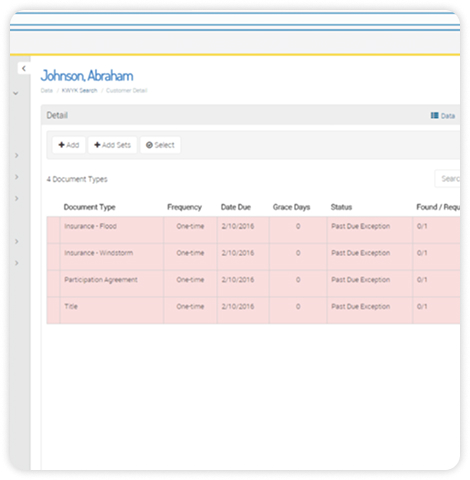

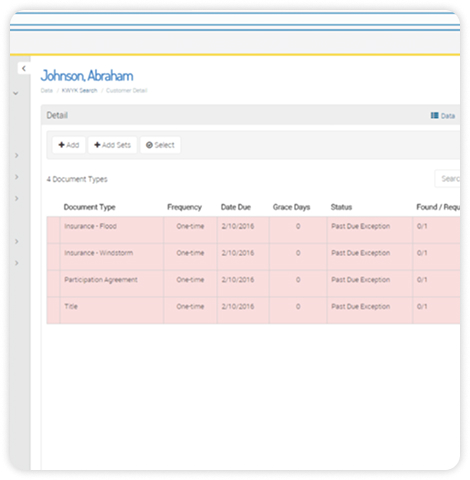

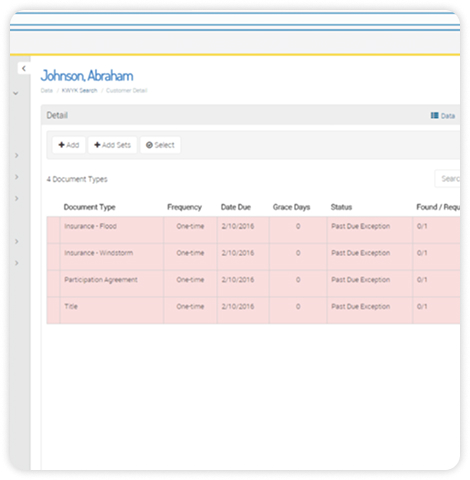

Connect disparate systems through intelligent data sharing that eliminates redundant entry and maintains accuracy across platforms. Identifi’s integration engine ensures customer information, account details, and document metadata remain synchronized in real-time.

WHAT YOU CAN DO WITH IDENTIFI

WHAT YOU CAN DO WITH IDENTIFI

Jeff Meyer

Chief Executive Officer, Dakota West Credit Union

FEATURES

Screen recognition technology surfaces relevant documents within existing workflows automatically.

Import from network folders, MFPs, and email systems with intelligent classification and indexing.

Bidirectional synchronization keeps document metadata aligned with changing business data automatically.

Direct connectivity with multi-function printers from any manufacturer with barcode recognition.

Professional development team handles custom integrations and unique system requirements.

Identifi integrates with all major core banking platforms, most loan origination systems, CRM applications, and multi-function printers. Our API platform supports custom integrations with legacy systems and specialized applications.

Standard core banking integrations require 4-6 weeks including setup, testing, and training. Custom integrations vary by complexity, but our professional services team manages projects to minimize operational disruption.

No. Integrations enhance existing processes rather than replace them. Testing occurs in parallel environments with coordinated implementation to ensure seamless transitions and minimal staff retraining.

Yes, our professional services team has extensive experience with legacy system integration, custom database connections, and unique data formats common in banking environments. We extend aging systems rather than replace them.

Desktop integration uses screen recognition technology to identify which application you’re using and automatically surfaces relevant documents. Users stay within familiar applications while gaining access to complete document repositories.

All integrations use encrypted connections, secure authentication protocols, and role-based access controls. Data flows maintain the same security standards as your core banking system with comprehensive audit logging.

Absolutely. Our professional services team provides ongoing maintenance, updates, and support for custom integrations. We also handle system upgrades and changes to ensure continuous connectivity.

Yes, integration configurations can be updated as business needs change, systems are upgraded, or new applications are added to your technology stack without disrupting existing workflows.

TALK TO OUR TEAM

Stop working in silos. Connect your systems for unified workflows, enhanced efficiency, and full visibility with Identifi’s proven integration platform.

Book a demo to see system integration designed for modern banking operations: secure, seamless, and fully compliant.