PRODUCT FEATURES

Real-time monitoring identifies missing documents and generates early alerts with dashboard visibility across departments.

PRODUCT FEATURES

Staff must confirm actual document receipt and storage before clearing compliance exceptions—no assumptions. Integration with document management systems ensures requirements are only satisfied when files are securely stored and accessible.

PRODUCT FEATURES

Smart scheduling regenerates compliance obligations based on business events and regulatory schedules without manual intervention.

Kimberlee Gloor

Senior Records Manager, First Tech

FEATURES

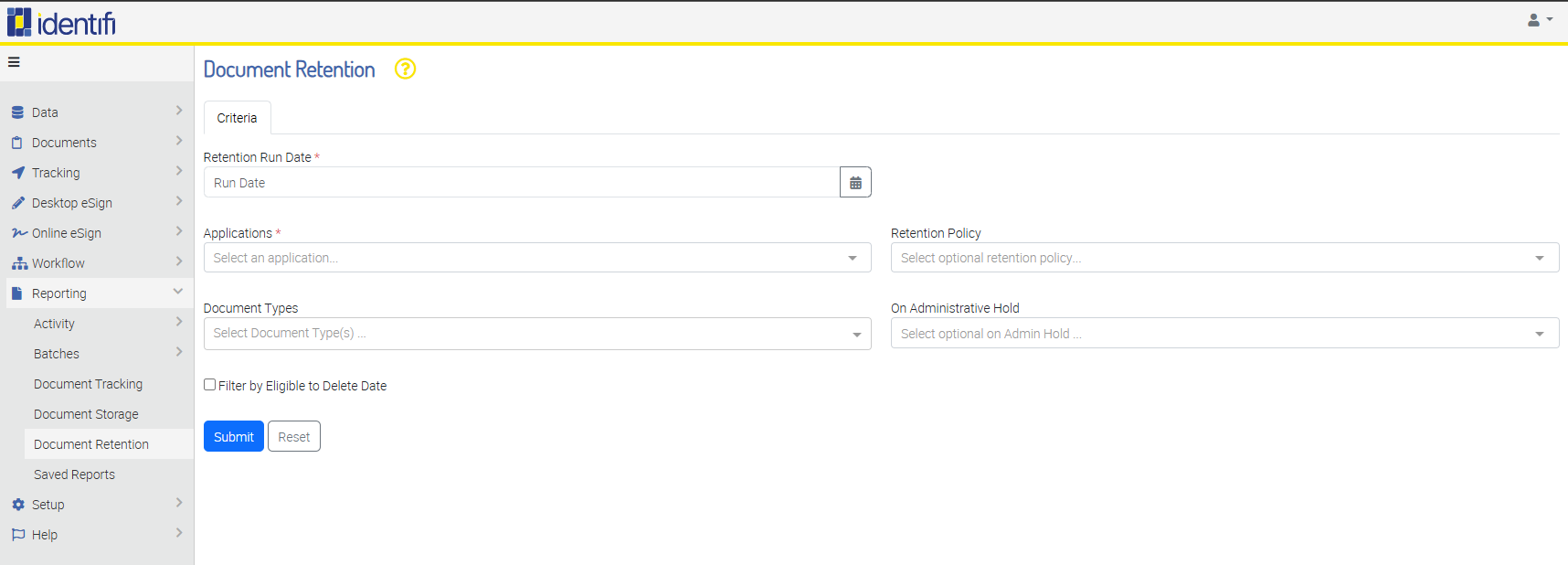

Identifi inspects your core banking system using configurable business rules to detect requirements automatically based on loan originations, account openings, and regulatory schedules. The system learns your specific compliance needs through rule configuration.

Yes, configure acceptable grace days for any document type to accommodate normal processing delays while maintaining compliance oversight. Different documents can have different grace period rules based on business needs.

TALK TO OUR TEAM

Stop hunting for missing documents and rely on verified, organized records. Identifi flips messy file storage into a streamlined, searchable system so your team can manage compliance with confidence.

Book a demo to see how automated document tracking can simplify verification, maintain audit trails, and keep your FI exam-ready.