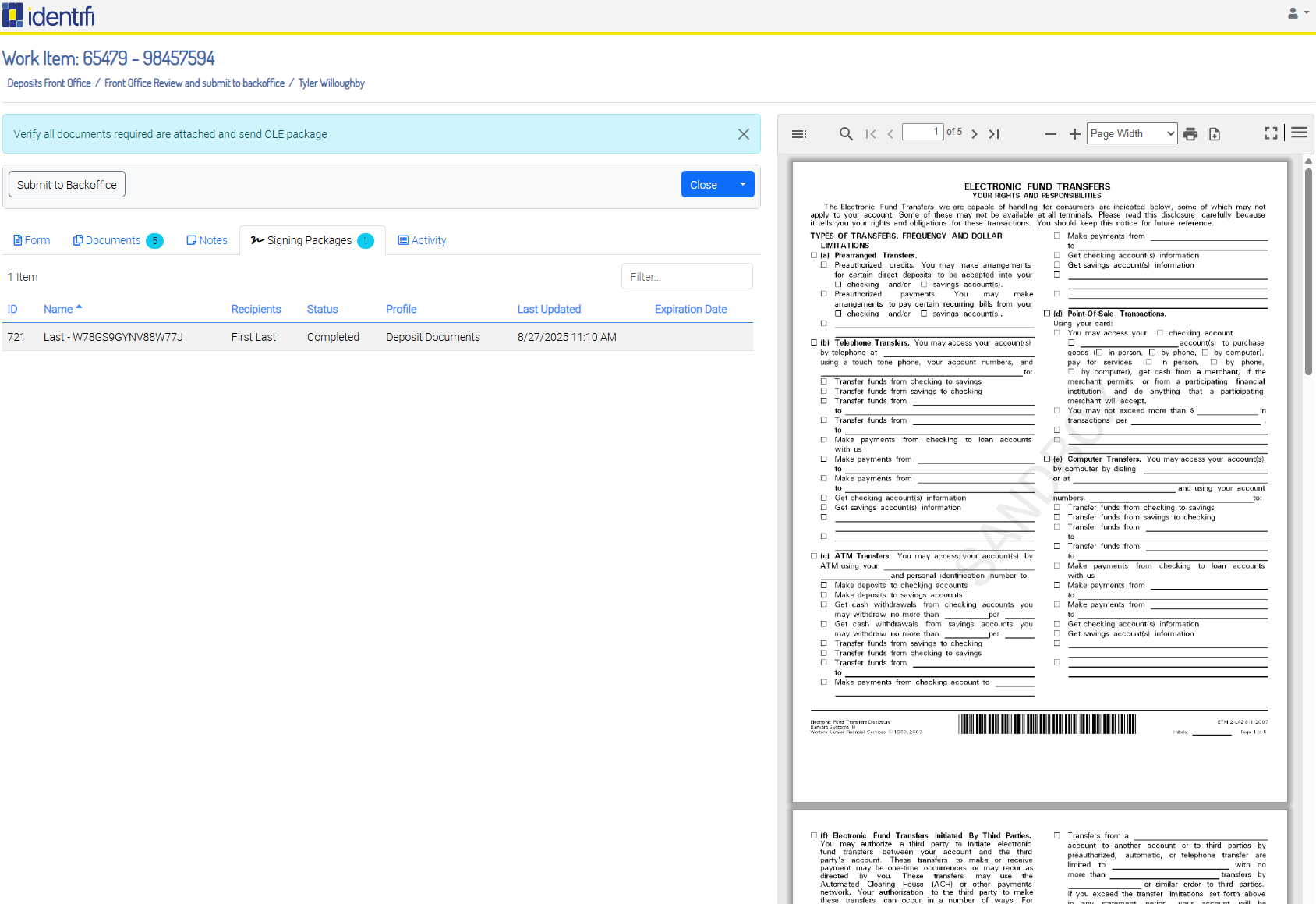

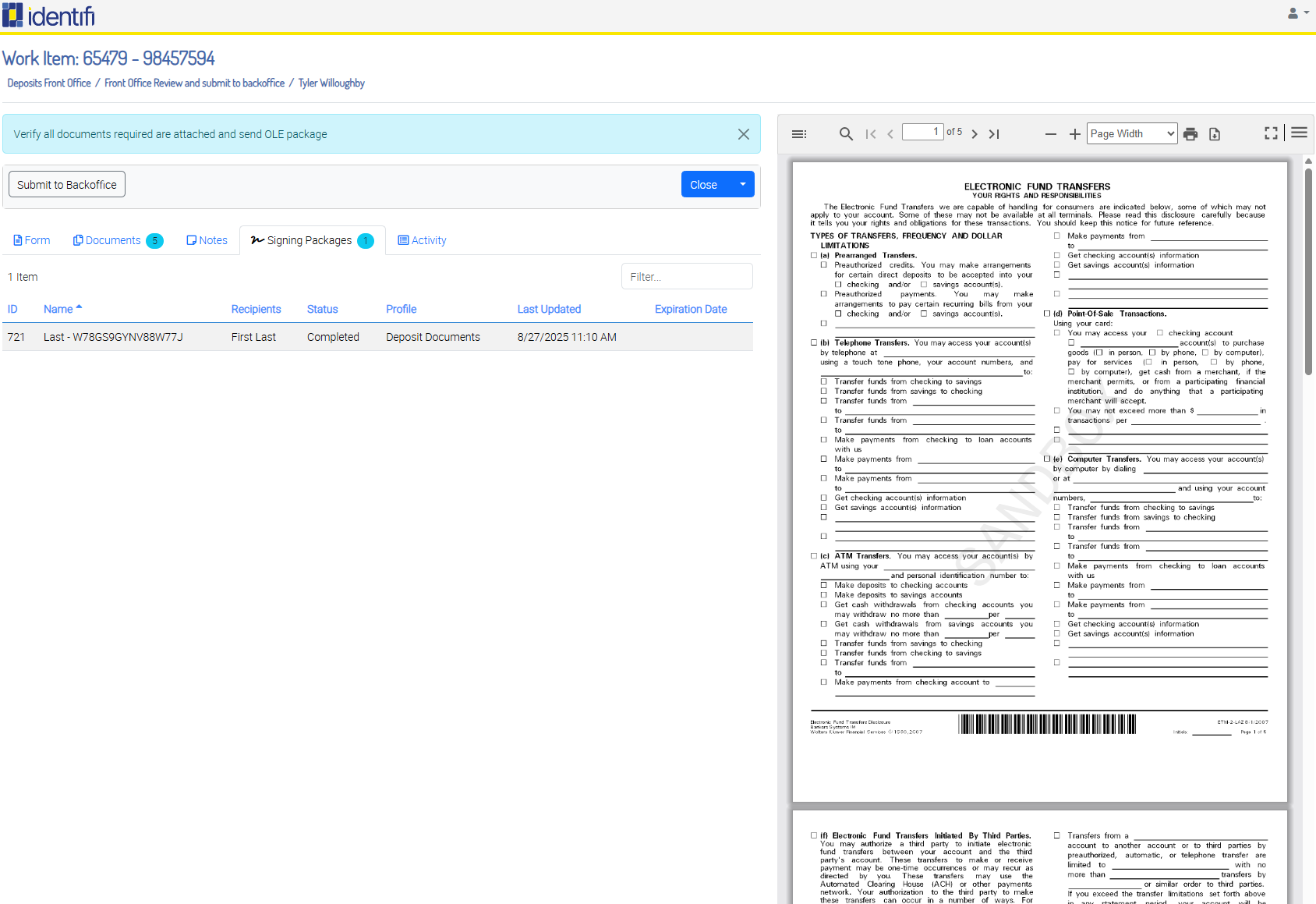

ELECTRONIC RECEIPT MANAGEMENT

Paperless transactions.

Digital convenience.

Stop printing receipts that end up in boxes your staff has to dig through later. Identifi captures transaction data at the source, applies secure signatures when needed, and delivers digital copies by email, while archiving searchable records that improve compliance, service, and efficiency.

PRODUCT FEATURES

Comprehensive metadata capture

Transform every receipt into a searchable business record that enhances operational intelligence. Capture transaction details, customer information, and contextual data to create a searchable database for instant inquiry resolution and trend analysis.

- Automatic categorization by transaction type, amount, location, and customer profile

- Find any transaction using customer name, amount, date range, or transaction details

- Link receipts to account activities, dispute investigations, and customer service inquiries

- Generate insights on transaction patterns, peak periods, and customer behavior trends

- Transaction data flows seamlessly between POS, core banking, and document management systems

PRODUCT FEATURES

Preference Management System

Meet modern customer expectations and preferences for email, paper, or both delivery methods with secure digital access and tamper-evident security.

- Individual settings for email, paper, or both delivery methods with easy modification

- Secure digital receipts delivered immediately after transaction completion

- Receipts display perfectly on smartphones and tablets for easy customer access

- Digital signatures and encryption ensure receipt integrity and prevent unauthorized modifications

- Custom templates maintain institutional branding across all digital communications

PRODUCT FEATURES

Automated High-Speed Operations

Optimize drive-thru and high-volume operations with wireless signature pads and barcode processing that eliminate bottlenecks.

- Cordless pads enable efficient drive-thru operations without compromising security

- Printed receipts with unique codes streamline pneumatic tube processing and verification

- System scales automatically during high-volume periods without performance degradation

- Instant capture and processing maintains service speed while ensuring complete documentation

- Streamlined interfaces reduce training requirements and minimize transaction processing time

Member convenience that enhances the cooperative banking experience.

Members notice when their credit union adopts technology that makes banking easier. Email receipts and instant digital access show forward-thinking service while controlling operating costs that help preserve competitive rates and fees.

- Deliver email receipts that enhance modern member experience

- Control costs while maintaining cooperative advantages in pricing

- Speed drive-thru service by eliminating paper handling

30%

Faster loan processing

80%

Reduction in paper usage

99.9%

Audit & compliance accuracy

High-volume transaction processing that scales without operational complexity.

Large transaction volumes demand scalable automation. Identifi streamlines receipt handling across locations, applying flexible business rules while ensuring audit-ready records and regulatory compliance.

- Automate capture, classification, and archival for thousands of daily transactions

- Apply rules by transaction type, threshold, or customer segment

- Maintain audit trails and compliance automatically across all branches

30%

Faster loan processing

80%

Reduction in paper usage

99.9%

Audit & compliance accuracy

If a member comes to us and questions a fraudulent transaction, we can quickly and easily go into Identifi, find a signed receipt and start an investigation for them. It’s much better than searching through a mountain of paperwork.

Kimberlee Gloor

Senior Records Manager, First TechFeatures

Complete e-receipt processing

for all banking transaction environments.

Visual Receipt Designer

Accommodate different receipt formats with custom branding and messaging for various locations and services.

Custom Transaction Rules

Configure signature requirements and delivery preferences based on transaction type, amount, or customer classification.

Signature Capture

Record biometric data and create tamper-evident seals for transactions requiring legal signature verification.

Email Delivery

Send receipt copies via email with secure links and customizable brand templates.

Drive-Thru Integration

Support wireless signature pads and pneumatic tube barcode scanning for complete drive-thru workflow automation.

Barcode Processing

Generate and process barcoded receipts with automated indexing and transaction data extraction capabilities.

Complete Archive System

Store receipts with complete transaction metadata enabling instant search by any criteria for superior customer service.

POS System Connectivity

Integrate seamlessly with existing point-of-sale systems using virtual printer technology without operational disruption.

What financial institutions need to know about Identifi e-receipts

How do electronic receipts integrate with our existing transaction systems?

Identifi connects with your POS systems using virtual printer technology. When your system “prints” transaction data, Identifi captures it automatically, processes signatures if required, and archives with complete transaction metadata.

Can we set different signature requirements for different transaction types?

Yes. Configure signature requirements based on transaction type, dollar amount, customer classification, or any business rule. You might require signatures only for withdrawals above certain amounts or specific transaction categories.

How does drive-thru electronic receipt processing work?

Use wireless signature pads for electronic signing, or print barcoded receipts that customers sign and return via pneumatic tube. Barcoded receipts are scanned automatically and indexed using transaction data for seamless workflow integration.

What transaction information is captured with receipts?

Identifi captures standard transaction data including date, time, amount, account details, transaction type, teller information, and location. This data automatically indexes receipts for easy search and retrieval.

Can customers choose how they receive receipts?

Absolutely. Customers can receive paper receipts, email copies, or both. You can set default preferences and business rules while allowing individual customer choice based on their preferences.

Are electronic receipt signatures legally valid?

Yes. Biometric signature capture creates tamper-evident seals with legal validity. Any attempt to modify receipts after signing renders signatures invalid, ensuring complete transaction integrity.

How quickly can we find specific transactions later?

Search any receipt using customer name, account number, date range, transaction amount, or transaction type. The system typically returns results in under one second for superior customer service.

What happens during peak transaction periods?

The system scales automatically to handle high-volume periods without performance degradation. Automated processing ensures consistent receipt handling regardless of transaction volume or timing.

TALK TO OUR TEAM

Turn paper piles into powerful insights

Stop letting receipts and transaction records sit in stacks. Identifi captures, organizes, and makes every receipt searchable.

Book a demo to see how automated e-receipts streamline capture, delivery, and archival while keeping every transaction compliant.