From commercial loans to wire transfers, Identifi replaces scattered, manual processes with automated workflows designed for banking environments—so your staff moves faster, your documents stay compliant, and nothing slips through the cracks.

PRODUCT FEATURES

Bridge gaps in your loan origination system with intelligent automation for complex processes your LOS wasn’t designed to handle.

PRODUCT FEATURES

Streamline lending workflows from origination through servicing with automated document collection, signature capture, and communication delivery.

PRODUCT FEATURES

Maintain operational excellence across all servicing activities with systematic workflow automation that ensures nothing falls through the cracks.

PRODUCT FEATURES

Eliminate compliance risks and inefficiencies of email-based document sharing through encrypted delivery workflows with complete audit trails.

Member servicing, made easier

Credit unions use Identifi to automate everything from member onboarding to vendor oversight. Build workflows that reduce back-office delays, improve visibility, and help you serve more members, faster.

35%

Faster approval processing

90%

Reduction in manual errors

30%

Improvement in productivity

Speed up high-volume, high-risk banking processes safely

Identifi Workflow helps banks digitize and automate the processes that impact compliance, turnaround time, and customer experience–all while integrating directly with core banking system and third-party apps.

70%

Audit findings reduced

50%

Higher customer satisfaction

90%

Better customer service

Jeff Meyer

Chief Executive Officer, Dakota West Credit UnionHOW WORKFLOW AUTOMATION WORKS

Identifi integrates seamlessly with your core systems—like Fiserv, Jack Henry, Corelation, and FIS—using REST APIs, SSO, and secure protocols to automate how documents, data, and approvals move.

It functions as your workflow engine, routing tasks across systems and teams, enforcing rules, and logging every step for complete visibility and compliance.

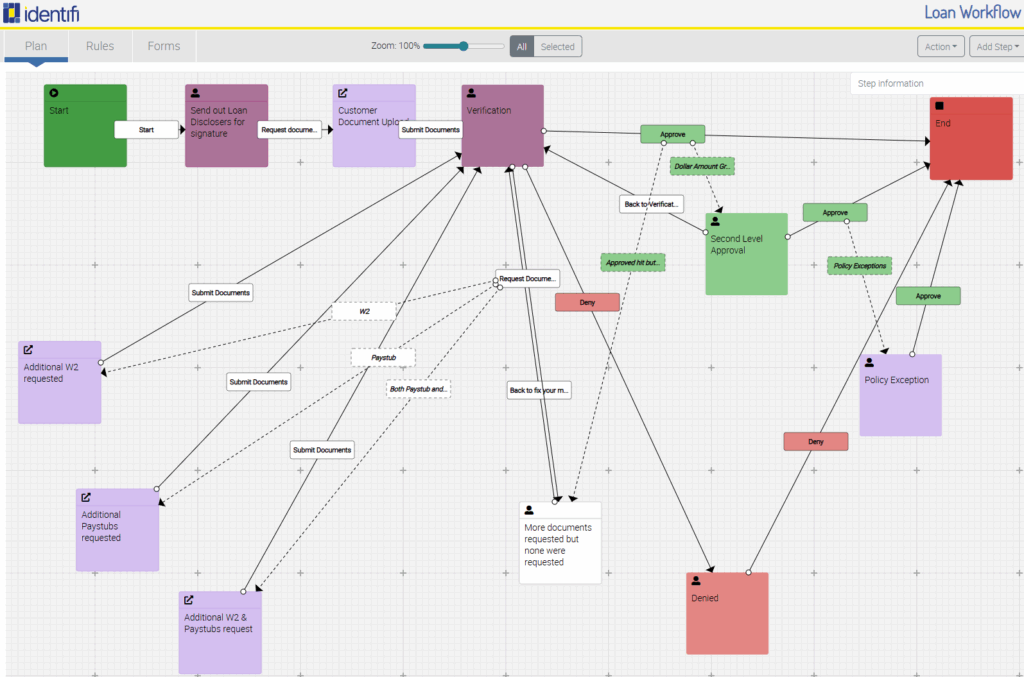

1

Create

visual workflows for lending, servicing, HR, and more with our drag-and-drop Process Designer

Configure

step logic, routing rules, and required approvals based on your institution’s exact process needs

Trigger

actions from form submissions, data inputs, or user decisions — all tracked in real time

2

Design

Branded, mobile-ready forms for onboarding, account opening, loan requests, and internal service needs.

Auto-fill

forms with member or account data pulled from your core or other connected systems.

Connect

each form to a predefined workflow that assigns tasks, notifies teams, and starts the right processes automatically.

3

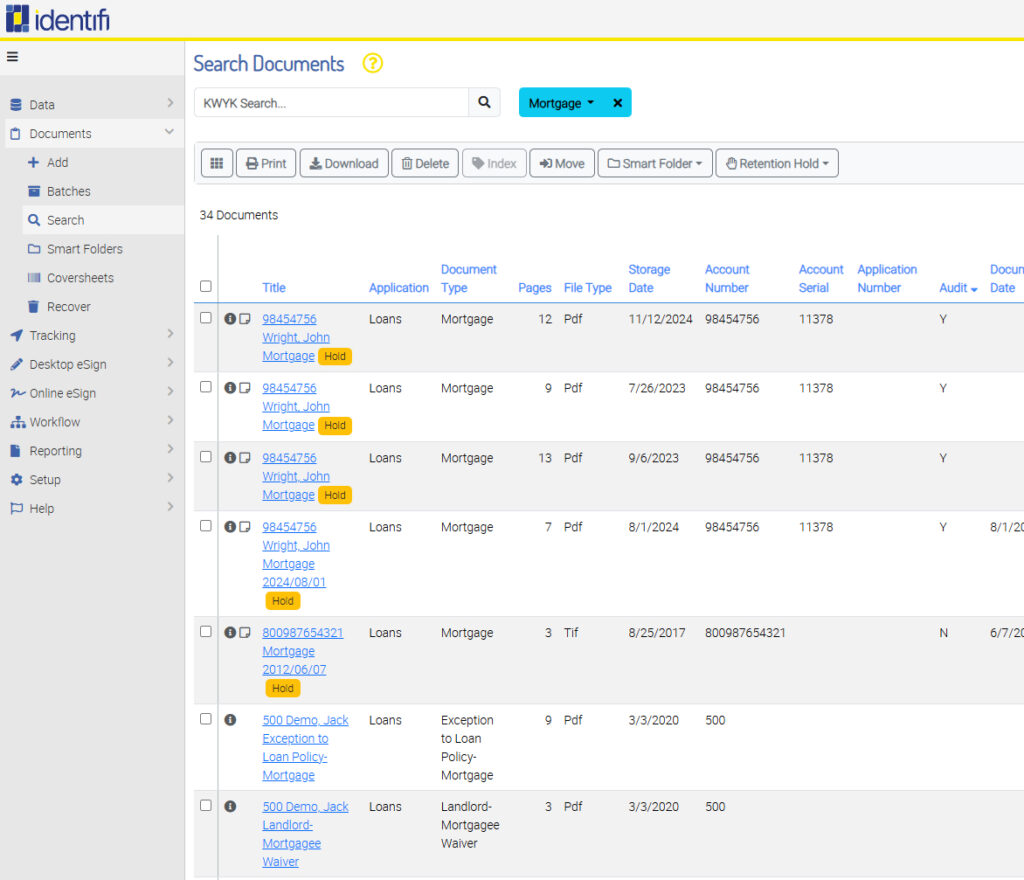

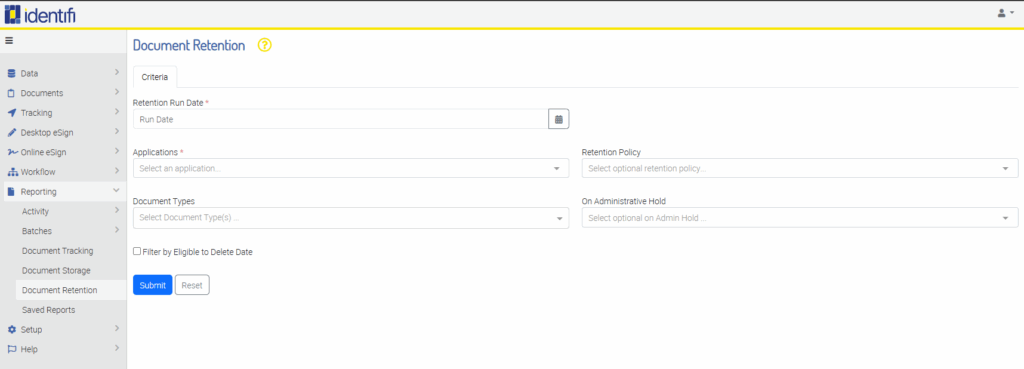

Version

branded, mobile-ready forms for onboarding, account opening, loan requests, and internal service needs.

Transition

live tasks to the newest workflow version automatically, so updates are applied midstream without restarts.

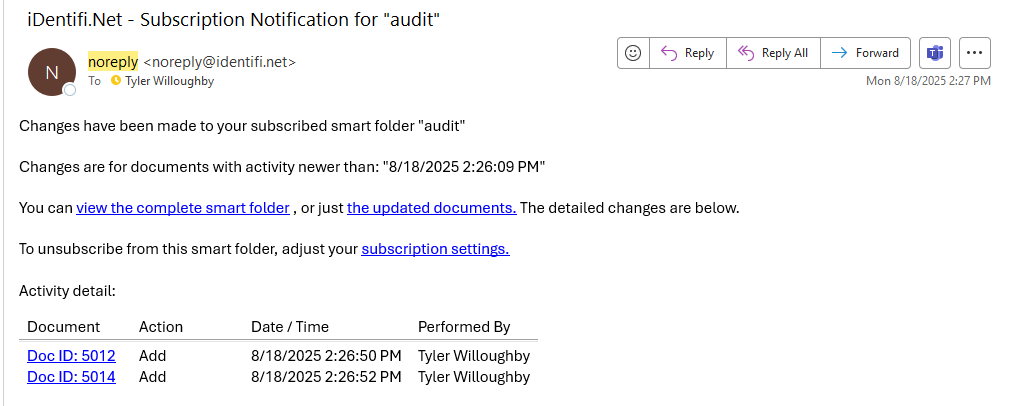

Track

every change, action, and decision with complete audit trails—giving you compliance peace of mind at every step.

Identifi connects to your core platforms—like Fiserv, Jack Henry, Corelation, and FIS—using APIs and secure protocols. It layers automation on top of your existing tools without replacing them, making your processes more efficient, auditable, and connected.

Yes, Identifi supports institution-wide workflows—from lending and member services to HR and compliance. You can build processes that include multiple departments, systems, and handoffs.

Recurring or regulated workflows with documents, approvals, or deadlines. Think: commercial loan packages, account opening, wire transfer approvals, new employee onboarding, and annual vendor reviews.

Yes. Every workflow step is tracked with a time-stamped, tamper-proof audit trail. You’ll have a full record of who did what, when, and why, making it easier to prepare for audits, respond to examiners, and stay compliant year-round.

Identifi supports real-time versioning so you can revise logic, steps, or documentation requirements without halting the workflow or starting over. In-flight processes automatically transition to the new version.