Digitize critical processes, automate document workflows, and simplify servicing so your team moves faster, and your customers get the experience they expect.

HOW WE HELP BANKS

Identifi helps banks eliminate manual, paper-heavy tasks with secure, automated workflows. Turn documents into real-time data, simplify servicing, and deliver faster, smarter banking at every step.

PRODUCT FEATURES

Commercial lending moves faster when documents route intelligently and nothing gets stuck. Real-time visibility shows exactly where every deal stands.

PRODUCT FEATURES

Transform paper processes into secure digital workflows that customers actually want to use. Everything gets encrypted, tracked, and stored properly.

PRODUCT FEATURES

Stop re-entering customer information and chasing approvals across departments. Connected systems mean everyone has what they need when they need it.

25%

Banks using Identifi report 25% higher Net Promoter Scores.

70%

70% of compliance fines stem from incomplete or missing documentation. Get it right the first time with Identifi.

15%

15% of an organizations revenue is tied up through document related challenges. Escape the document pitfalls with Identifi.

Product Suite

From secure document management to powerful workflow automation, Identifi helps you work smarter, reduce risk, and deliver the quality, timely service your customers need.

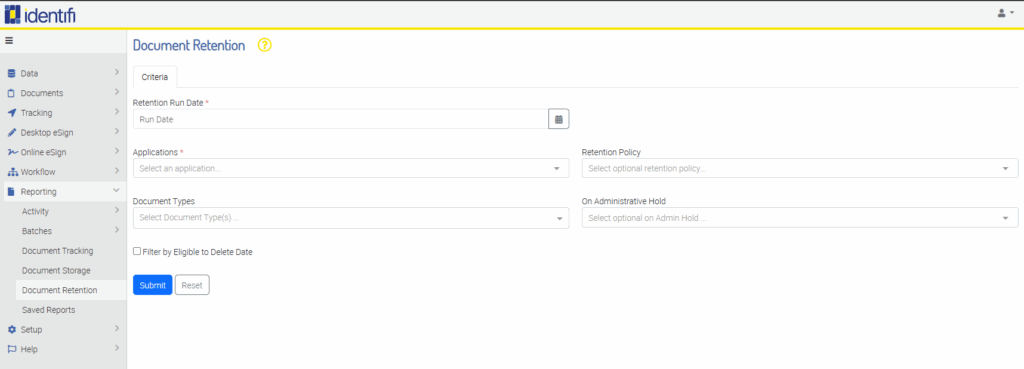

Track any kind of document automatically, ensuring rigorous compliance and timely document retention and submission.

Track any kind of document automatically, ensuring rigorous compliance and timely document retention and submission.

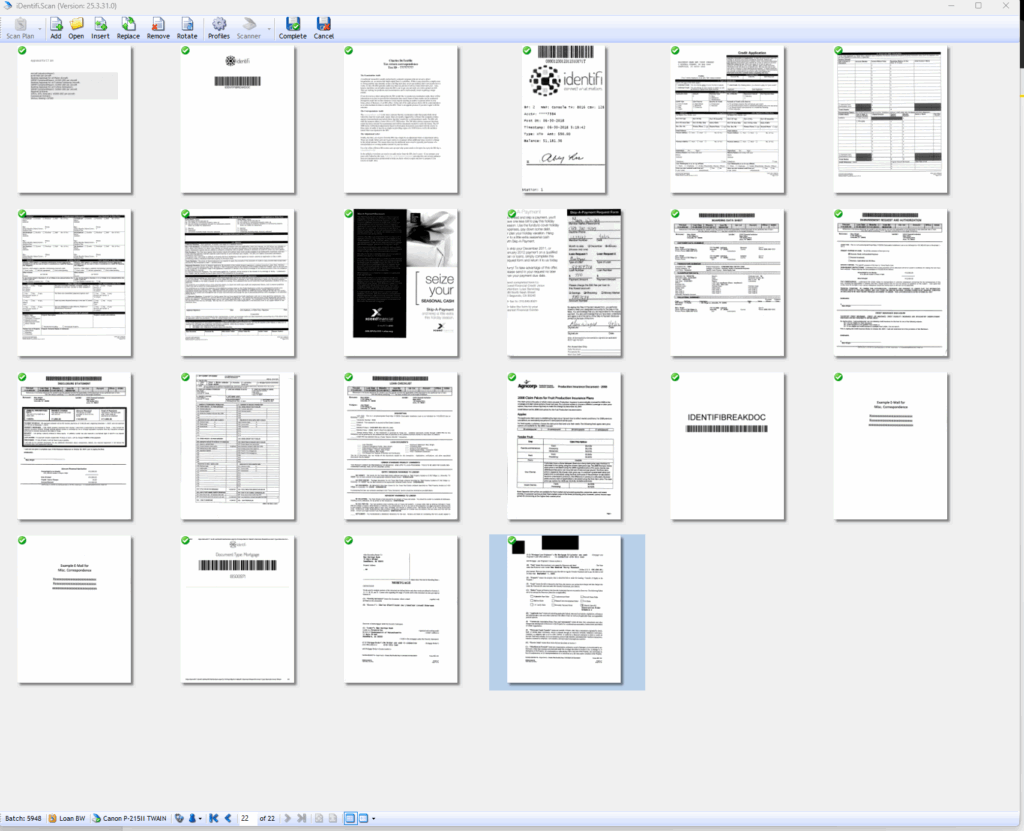

Explore MoreBuild digital-first, automated document and data workflows that put your customers at the center of your business process.

Build digital-first, automated document and data workflows that put your customers at the center of your business process.

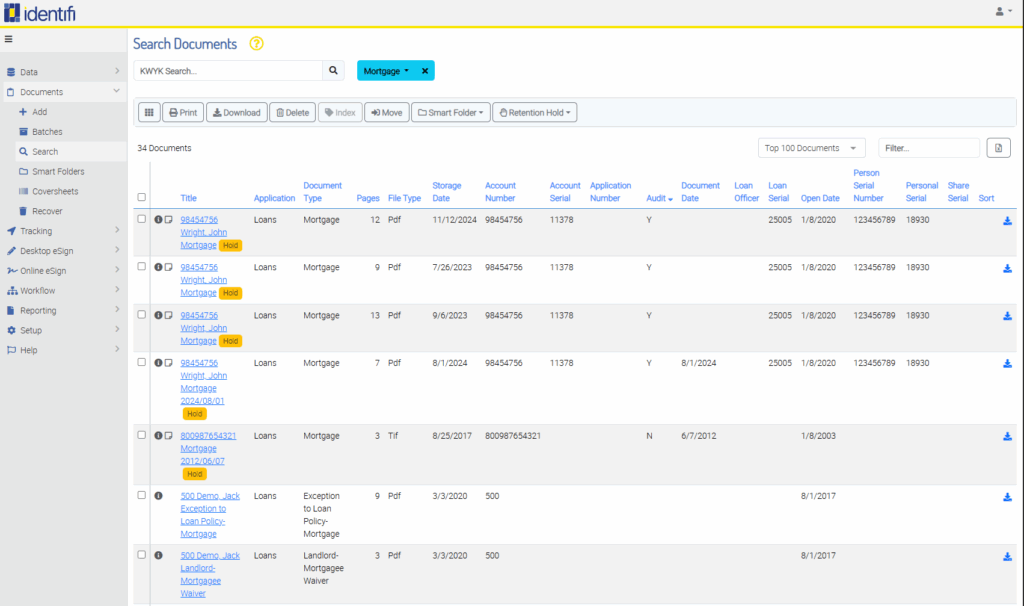

Explore MoreManage millions of operational documents through an encrypted repository with state-of-the-art ECM capabilities.

Manage millions of operational documents through an encrypted repository with state-of-the-art ECM capabilities.

Explore MoreUnlock new possibilities by connecting any of our solutions to your current systems and third-party applications.

Unlock new possibilities by connecting any of our solutions to your current systems and third-party applications.

Explore MoreSign documents anywhere, anytime—no branch visit required. Move faster, approve sooner, and keep your service moving forward.

Sign documents anywhere, anytime—no branch visit required. Move faster, approve sooner, and keep your service moving forward.

Explore MoreConnect to your core system to automate statement data, formatting, delivery, and archival, hands-free.

Connect to your core system to automate statement data, formatting, delivery, and archival, hands-free.

Explore MoreSecurely provide customers with signed receipts via email using advanced signature tablet technology that’s safer and faster.

Securely provide customers with signed receipts via email using advanced signature tablet technology that’s safer and faster.

Explore More

“I want all of you to know how much we appreciate you and your company. We keep saying it, and we really mean it. You are the best vendor we have. You always have a solution or a suggestion for us that fixes most any challenge we dream up.”

Kevin McMinn

SVP, Sr Direct of Loan Ops and Systems, B1 Bank

BENEFITS

Your customers expect seamless digital experiences, and Identifi helps you deliver. From shortening loan cycles to streamlining back-office ops, we make every workflow easier to manage, and every service faster to provide.

Automate document collection, routing, and approvals to cut up commercial loan processing and reduce risk.

Replace slow, paper-heavy processes in servicing, account maintenance, and internal reviews.

Digitally onboard customers with workflows that handle ID verification, disclosures, and regulatory checks.

Standardize workflows, cut manual data entry, and eliminate redundant tasks across your organization.

Track and manage documentation with built-in audit trails and exception handling that reduce regulatory headaches.

Connect seamlessly to systems like Jack Henry, Fiserv DNA, and FIS for faster access and automated data sync.

Start turning paper-based processes into streamlined, digital-first servicing, with Identifi. Enter your email and get started.