Identifi is a document management and workflow automation engine that streamlines your services and syncs with your core system.

What We Help You With

Modernize workflows, cut friction, and safeguard compliance with Identifi

Convert paper-based servicing processes into seamless digital workflows for any document or data-specific operation.

Keep every document in check and every requirement on track with compliance built into your current processes.

Digitize customer servicing workflows to deliver faster service, fewer errors, and more personalized FI experiences.

PRODUCT SUITE

From document management and tracking to pre-built, automated workflows, Identifi keeps you organized and ready to run—with tools that let you service at the speed of modern banking.

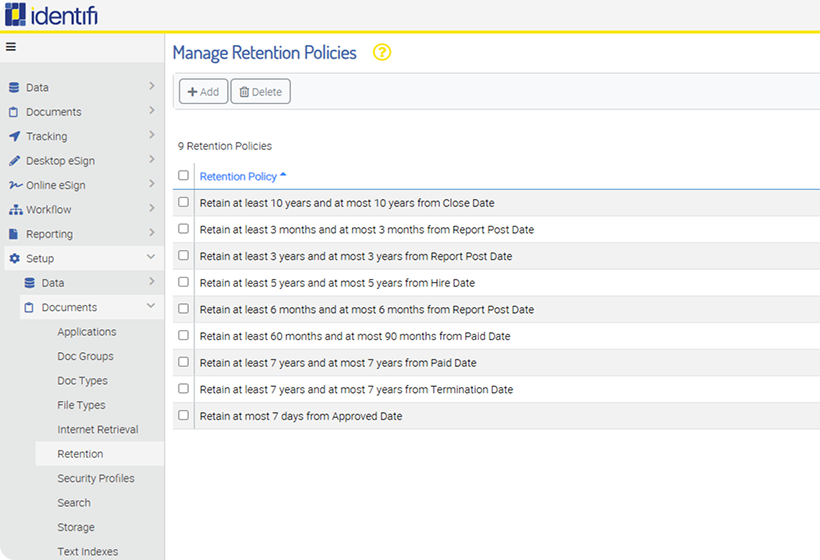

Track any kind of document automatically, ensuring rigorous compliance and timely document retention and submission.

Track any kind of document automatically, ensuring rigorous compliance and timely document retention and submission.

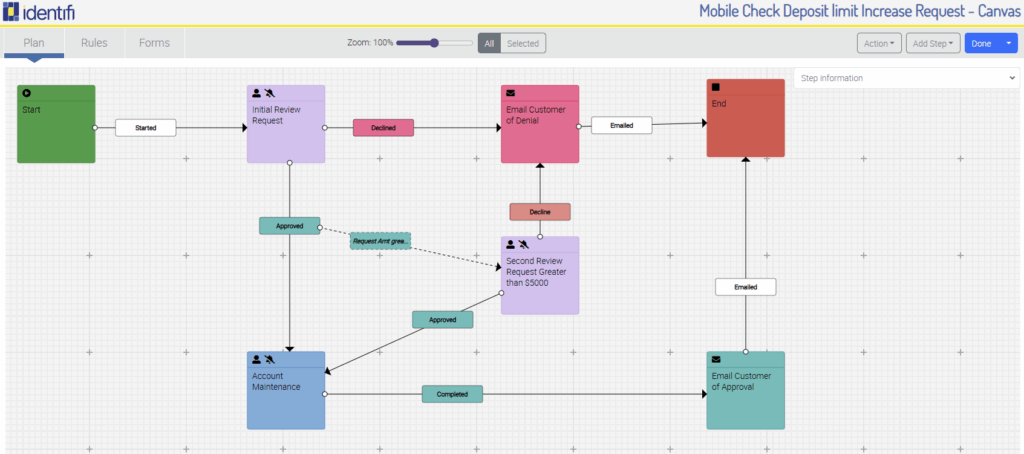

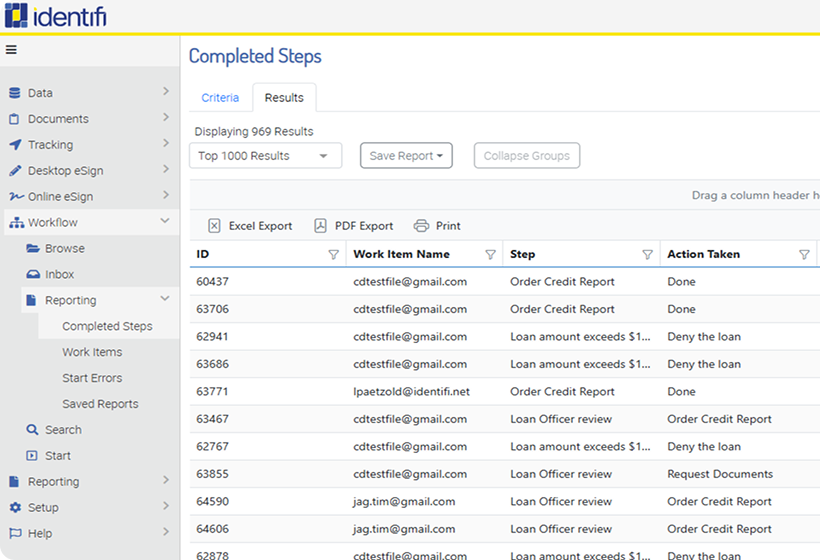

Explore MoreBuild digital-first, automated document and data workflows that put your customers at the center of your business process.

Build digital-first, automated document and data workflows that put your customers at the center of your business process.

Explore MoreManage millions of operational documents through an encrypted repository with state-of-the-art ECM capabilities.

Manage millions of operational documents through an encrypted repository with state-of-the-art ECM capabilities.

Explore MoreUnlock new possibilities by connecting any of our solutions to your current systems and third-party applications.

Unlock new possibilities by connecting any of our solutions to your current systems and third-party applications.

Explore MoreSign documents anywhere, anytime—no branch visit required. Move faster, approve sooner, and keep your service moving forward.

Sign documents anywhere, anytime—no branch visit required. Move faster, approve sooner, and keep your service moving forward.

Explore MoreConnect to your core system to automate statement data, formatting, delivery, and archival, hands-free.

Connect to your core system to automate statement data, formatting, delivery, and archival, hands-free.

Explore MoreSecurely provide customers with signed receipts via email using advanced signature tablet technology that’s safer and faster.

Securely provide customers with signed receipts via email using advanced signature tablet technology that’s safer and faster.

Explore MoreIntegrations

Corelation. Jack Henry. FIS. Fiserv. COCC. No matter which core you work with, Identifi works with it, too—ensuring compliance, security, and speed, without friction.

When you run faster, your members get there sooner.

Identifi helps credit unions streamline servicing, from loans to account updates.

So teams work smarter, audits get cleaner, and members get faster responses.

Faster document routing times

Reduction in paper usage

Audit & compliance accuracy

Less paper. More precision. Faster everything.

Identifi helps banks move faster–from loan origination to account servicing–so you can reduce friction, improve accuracy, and meet rising expectations for digital-first service.

Faster signature capture

Savings gain with document

module deployment

Reduction in compliance related costs

Resources

7.5%

The average FI loses 7.5% of all documents annually. Identifi’s ECM suite helps reduce these losses by streamlining document management.

Now that we’ve streamlined operations and eliminated paper documents, we can take on more strategic projects without having to hire new staff.”

Bethany Cottrell

Core Systems Manager,

People’s Credit Union

CASE STUDY

We helped People’s Credit Union eliminate paper-based processes by implementing Identifi’s ECM suite, including eSign, eReceipt, and Trak modules. This transformation enhanced operational efficiency, improved document access, and enabled staff to focus on strategic initiatives without additional hires.

CASE STUDY

See how we helped Dakota West Credit Union streamline operations by integrating Identifi’s ECM with their new Fiserv DNA core, replacing manual processes with centralized digital workflows to support rapid growth and enhance member service.

$120

The average FI spends $120 for each misfiled document. Centralizing documents with Identifi makes retrieval faster and more accurate.

Having everything in one place meant we only had to know one system to retrieve anything, including reports statements, signature cards, and loan documents.

Jeff Reiter

Chief Executive Officer

Dakota West Credit Union

Start turning paper-based processes into streamlined, digital-first servicing, with Identifi. Enter your email and get started.