Digitize your most important documents, data processes, and servicing workflows in one platform. Work smarter, act faster, and make it easier to put your members first.

How We Help Credit Unions

Digitize your most important documents, data processes, and servicing workflows in one platform. Work smarter, act faster, and make it easier to put your members first.

PRODUCT FEATURES

No more delays when members need loans, want to open accounts, or request changes. Identifi handles the routing, tracking, and follow-up so every interaction moves fast.

PRODUCT FEATURES

Stop worrying about retention schedules and missing documentation. Built-in NCUA compliance tools handle the regulatory work so you can focus on members.

PRODUCT FEATURES

No more emails flying between departments or wondering if tasks got done. The platform manages the handoffs while your team focuses on building, and maintaining, relationships.

$50

Between $35 to $50 in recovered productivity per employee every time a workflow is utilized.

50%

Average time savings for employees over handling manual document processes.

70%

Increase audit prep efficiency utilizing smart folders to flag documents for upcoming audits.

Product Suite

From secure document management to automated workflows, Identifi helps credit unions work smarter, stay compliant, and serve members faster—everywhere they expect you to be.

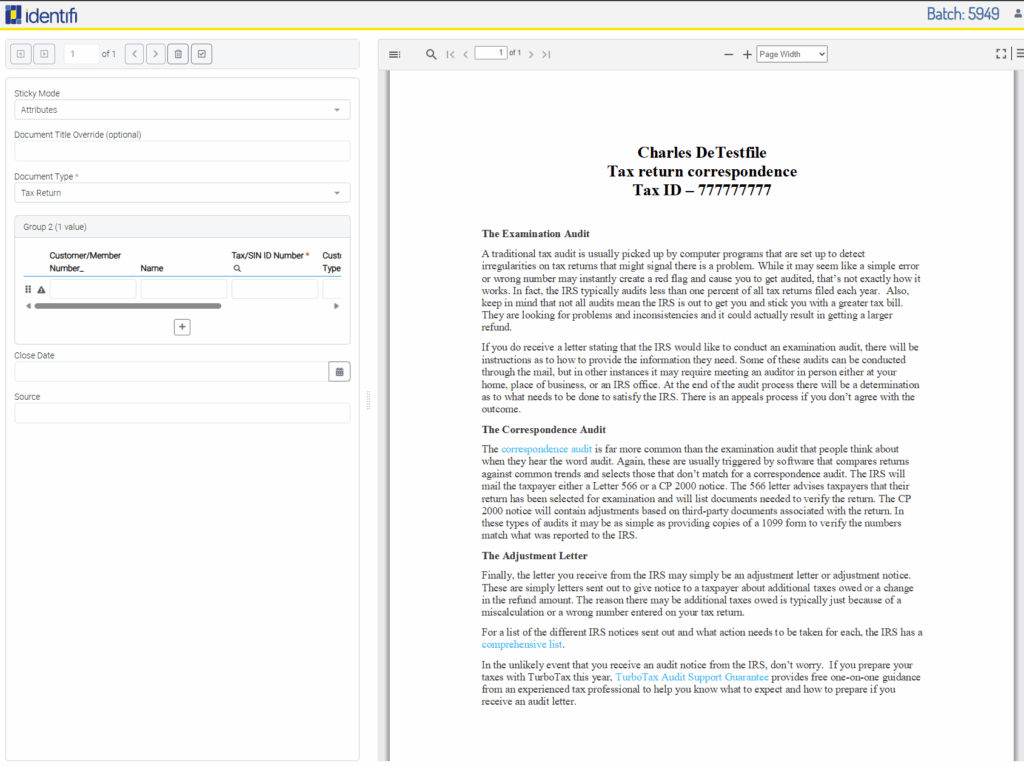

Track any kind of document automatically, ensuring rigorous compliance and timely document retention and submission.

Track any kind of document automatically, ensuring rigorous compliance and timely document retention and submission.

Explore MoreBuild digital-first, automated document and data workflows that put your customers at the center of your business process.

Build digital-first, automated document and data workflows that put your customers at the center of your business process.

Explore MoreManage millions of operational documents through an encrypted repository with state-of-the-art ECM capabilities.

Manage millions of operational documents through an encrypted repository with state-of-the-art ECM capabilities.

Explore MoreUnlock new possibilities by connecting any of our solutions to your current systems and third-party applications.

Unlock new possibilities by connecting any of our solutions to your current systems and third-party applications.

Explore MoreSign documents anywhere, anytime—no branch visit required. Move faster, approve sooner, and keep your service moving forward.

Sign documents anywhere, anytime—no branch visit required. Move faster, approve sooner, and keep your service moving forward.

Explore MoreConnect to your core system to automate statement data, formatting, delivery, and archival, hands-free.

Connect to your core system to automate statement data, formatting, delivery, and archival, hands-free.

Explore MoreSecurely provide customers with signed receipts via email using advanced signature tablet technology that’s safer and faster.

Securely provide customers with signed receipts via email using advanced signature tablet technology that’s safer and faster.

Explore More

Now that we’ve streamlined operations and eliminated paper documents, we can take on more strategic projects without having to hire new staff.

Bethany Cottrell

Core Systems Manager, People’s Credit Union

BENEFITS

Your members expect seamless, digital experiences—because they get them everywhere else. Identifi helps you keep up with service that’s faster, smarter, and easier to manage. So your CU stays competitive and your members stay.

Accelerate consumer, auto, and mortgage lending with faster approvals, automated routing, and built-in eSignature tools.

Keep member documents moving with smart workflows that assign, notify, and follow up—automatically and securely.

Connect seamlessly to systems like Corelation, Fiserv DNA, and COCC for faster access and automated data sync.

Automatically flag missing vendor documentation, route exceptions, and stay ahead of audit deadlines.

Cut the paper and streamline new accounts, teller receipts, and member service forms from end to end.

Standardize document retention, verified signatures, and system-wide tracking keep you compliant and audit-ready.

Start turning paper-based processes into streamlined, digital-first servicing, with Identifi. Enter your email and get started.