Monthly statement cycles shouldn’t drain your operations team with days of manual coordination. Identifi automates core data extraction, template formatting, and multi-channel delivery—while ensuring full compliance and audit readiness across every statement type your institution produces.

PRODUCT FEATURES

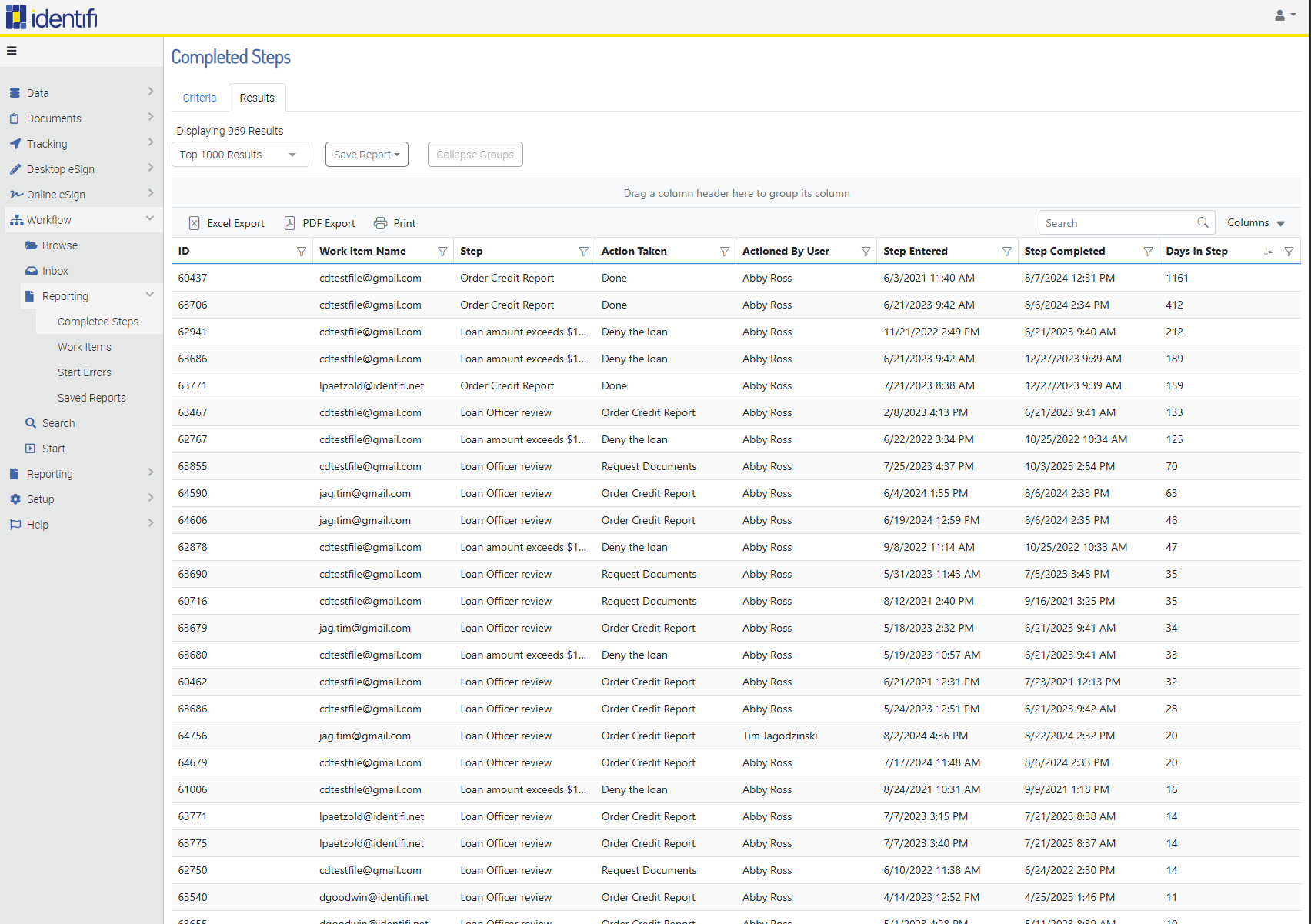

Transform labor-intensive statement cycles into background processes that automatically handle data extraction, formatting, and delivery coordination while staff focus on customer service.

PRODUCT FEATURES

Our engagement tools transform compliance obligations into revenue opportunities through personalized messaging and targeted offers based on customer behavior.

PRODUCT FEATURES

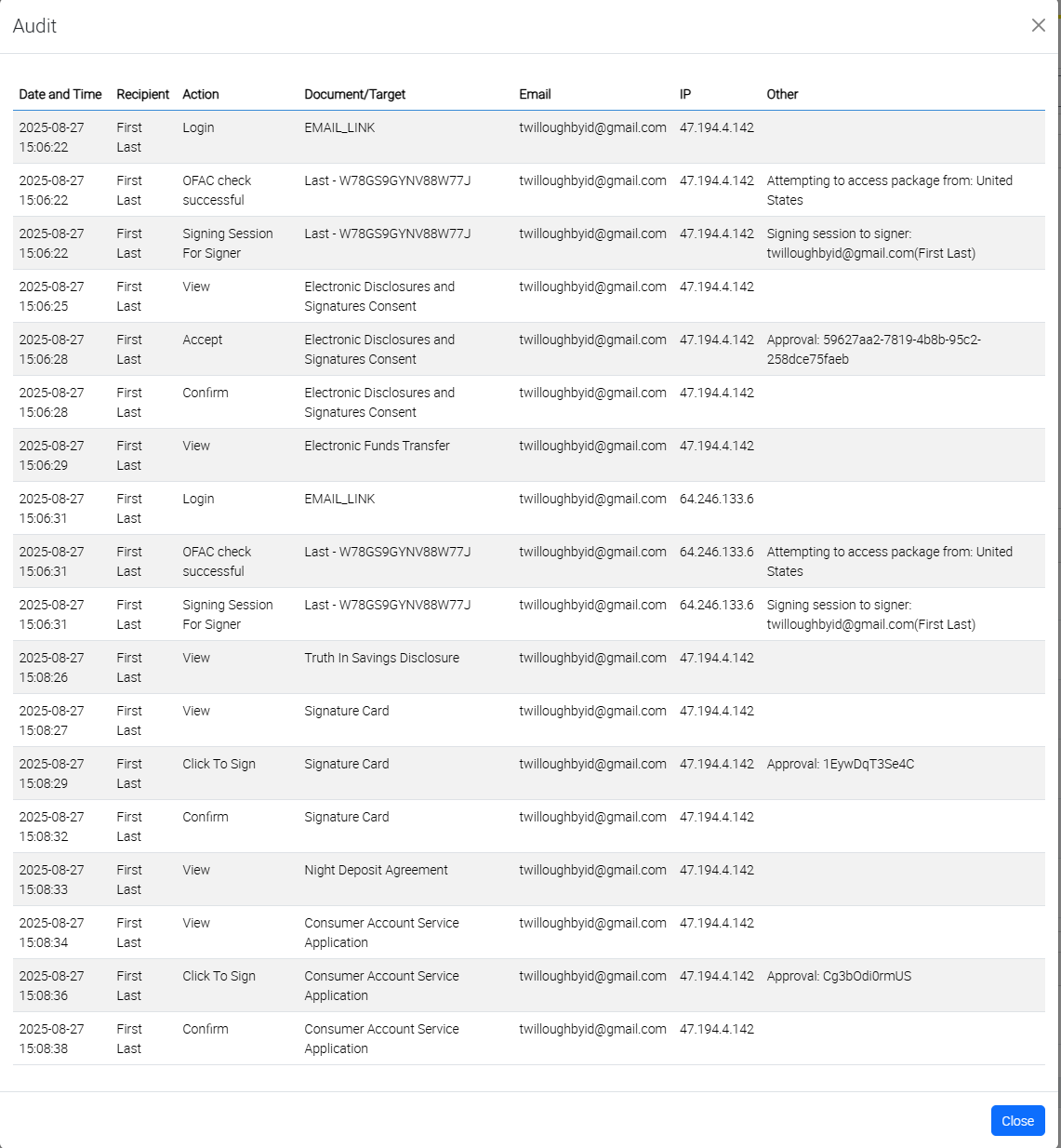

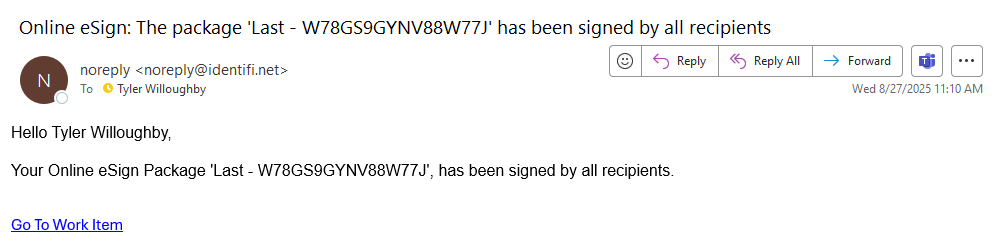

Ensure every statement reaches its recipient through comprehensive tracking, automated exception handling, and complete audit trail documentation.

Members expect clear, reliable communication from institutions they trust with their financial lives. Consistent, personalized statements reinforce the member-first service that defines credit unions.

Banks juggle multiple statement types across retail, commercial, and wealth management. Identifi automates complexity while preserving compliance and brand consistency across every business line.

Having everything in one place meant our staff only had to know one system to be able to retrieve anything, including reports statements, signature cards and loan documents.

Jeff Meyer

Chief Executive Officer, Dakota West Credit Union

FEATURES

Dynamic content insertion using account data and transaction history.

Complete confirmation tracking with bounce management and returned mail processing.

Identifi connects directly to your core banking system to extract account data automatically during your statement cycle. The platform handles formatting, delivery, and archival without disrupting existing workflows or requiring manual intervention.

Yes, the personalization engine allows dynamic content insertion based on account behavior, transaction patterns, and customer segmentation. Add targeted offers, educational content, or personalized insights that turn statements into engagement opportunities.

Identifi tracks all delivery attempts and automatically manages exceptions. Bounced emails, returned mail, and other failures trigger escalation workflows with complete audit trails for compliance documentation.

Typical implementation requires 6-8 weeks including core integration, template design, testing, and staff training. Our professional services team manages the entire process to ensure smooth transition from existing statement workflows.

Absolutely. Create unique templates for checking, savings, loans, CDs, or any product line. Each template maintains consistent branding while accommodating different data requirements and regulatory disclosures.

Identifi processes from hundreds to millions of statements monthly without performance degradation. The platform scales automatically with your institution’s growth and statement volume requirements.

The system maintains complete delivery confirmation records, automated retention schedules, and comprehensive audit trails that satisfy regulatory requirements for statement delivery documentation and compliance reporting.

TALK TO OUR TEAM

Stop searching for documents and start finding them instantly. Identifi provides secure, searchable repositories that scale with your institution’s growth and complexity.

Book a demo to see enterprise document management built for banking operations.